Sports Betting Tax in 2023 – Can You Be Taxed on Sports Betting Winnings?

When you’re busy placing bets, the last thing you’re thinking about is tax on sports betting. However, if you win money, you will be expected to pay federal income tax on your winnings, providing you meet specific requirements. What’s more, you’ll also often be asked to pay sports betting tax on a state level, taking even more money away from your winnings.

On this page, we’ll be taking a close look at sports betting tax across the United States, showing you how much to pay and, perhaps more importantly, how you can legally reduce your tax bill. We’ll even be looking at whether you can altogether avoid paying taxes on your sports betting winnings by joining up with offshore sports betting sites.

|

50% up to $1000 Welcome Bonus |

|

Claim Now |

|

150% Match On The First Deposit Up To $150 |

|

Claim Now |

|

$750 Welcome Bonus (3 x $250 Bonuses) |

|

Claim Now |

|

|

50% Welcome Deposit Bonus up to $1000 |

|

Claim Now |

|

150% Deposit Bonus up to $2500 |

|

Claim Now |

|

|

Get a Welcome Bonus of up to $750 |

|

Claim Now |

|

125% Sign Up Bonus Up To $2,500 |

|

Claim Now |

|

50% Welcome Deposit Bonus Up To $500 + $10 Casino Chip |

|

Claim Now |

|

|

50% Sports Welcome Bonus Up To $1000 |

|

Claim Now |

|

50% First Time Deposit Match Up To $1000 |

|

Claim Now |

Paying Tax on Sports Betting – Sports Betting Tax Rates

Unfortunately, gamblers throughout the US are expected to pay federal income tax on all winnings. The amount you end up paying in federal taxes depends on how much you earn throughout the year. There are seven federal income tax brackets, and we’ve listed them below.

Amount Earned Flat Tax Tax Percentage $9,950 N/A 10% $9,951 to $40,525 $995 12% of everything earned over $9,950 $40,526 to $86,374 $4,664 22% of everything earned over $40,525 $86,376 to $164,925 $14,751 24% of everything earned over $86,375 $164,926 to $209,425 $33,603 32% of everything earned over $164,925 $209,426 to $523,600 $47,843 35% of everything earned over $209,425 $523,601+ $157,804.25 37% of everything earned over $523,600 Individual states will also usually tax winnings themselves, although the amount they tax is much less than that charged by the federal government. The state where the bet was placed usually charges the tax, not the state where the gambler resides. The amount of tax you pay to a state usually depends on your overall annual earnings and marital status.

Sportsbooks are expected to withhold 24% of net winnings when there’s a substantial payout, which is classed as over $5,000 with winnings are at least 300x your wager. This is for federal income tax. However, you might find that this is not enough when the end of the year comes around, as you’ve earned more than $164,925. If this is the case, you’ll be required to pay extra. If the 24% is more than you should have paid, you’ll receive a rebate. Some states will also withhold money for state taxes when also withholding money for federal taxes.

When the payer withholds a percentage of a gambler’s winnings to pay federal income tax, they will issue the gambler with Form W-2G, which shows how much income tax has been withheld. This form will also be sent to the IRS. This form will also be issued when there’s a win of $600, which is also equal to or greater than 300x the bet, but no tax will be withheld until the $5,000 threshold is reached.

It’s important to mention that tax will need to be paid on any money you win, even if the amount won doesn’t meet the threshold to have money withheld and Form W-2G issued. Anyone winning less than the requirement for tax to be withheld should report their winnings as “other income” on Form 1040, which is the standard document used when filing income tax returns with the IRS.

Is There Tax on Sports Betting?

In some countries around the world, such as the United Kingdom, there is no tax on sports betting. However, this is not the case in the United States, where anyone winning money will be expected to declare it as income. Don’t make the common mistake of thinking that only sums over a certain amount need to be reported, as everything, from wins of a few dollars to wins worth thousands, must be declared.

Different winners will pay different amounts of tax. This is because the amount of tax you pay to the federal government depends on how much you earn over the course of the year – it can be anything from 10% of your winnings to 37% of your winnings. Different states also have different state income taxes that will need to be paid. Some states have a flat income tax rate for everyone, while others have various tax brackets with differing tax rates.

How Much Tax Do You Pay on Sports Betting?

Yes, you are required to pay tax on sports betting winnings. The exact amount depends on where you’re gambling, as different states have different tax rates. However, regardless of where they are in the US, everyone must pay federal tax on gambling winnings.

It should be noted that you are also allowed to deduct gambling losses from your tax return, providing you itemize your records. Doing so can make a massive difference to the size of your tax bill, especially if you are a regular gambler. However, most people in the US filing tax returns take standard deduction, meaning gambling losses can’t be claimed.

Do You Have to Pay Tax on Sports Betting?

This is where things get a little gray. Legally speaking, anyone who wins money from gambling should declare their winnings and pay tax on them. However, what do you do if you’re playing at a gambling site in a state where online gambling is yet to be legalized? Do you want to be admitting to gambling when the law is not clear on the legality of it?

Even when you play at the best sportsbooks in the US, the onus is entirely on you to report and pay tax on the money you win – the site itself will not inform the IRS of any substantial wins, so the IRS will have no knowledge of you winning money. So, you could choose to withhold information of your winnings from the IRS and therefore not pay any tax on your winnings. You must decide whether you want to take the risk of not reporting any winnings.

Sports Betting Tax Rates

Before we look at the betting tax rates of various states, it’s worth reiterating this: regardless of where you are, there will be a tax on winnings charged by the federal government. Whether you win thousands in a Vegas sportsbook or a few dollars online at a Tennessee online sportsbook, it’s up to you to report your winnings. The amount of tax you end up paying to the federal government depends on your overall annual income.

But do you have to pay tax on sports betting winnings on a state level? The answer is: it depends. Each state chooses whether to levy a betting tax on players, plus they also get to choose the tax rate on sports betting. Below, you can find out about the state betting tax you’re expected to pay in some of the more prominent states with legal sports betting.

Alabama Sports Betting Tax Rate

Alabama has had the same tax bracket system since 2008. The tax rates range from 2% to 5% and cannot go beyond that 5% mark no matter what. The amount of money for each of these brackets—there are three total—doubles when filing your return jointly as a married couple.

Here are how the tax brackets shape up in Alabama.

- Income of $0 is taxed at 2%

- Income of $500.00 – $2,999 is taxed at 4%

- Income of $3,000 or more is taxed at 5%.

Learn more about betting in Alabama in our Alabama Sports Betting Guide.

Alaska Sports Betting Tax Rate

Alaska does not have any state income tax, and the tax system has not changed in the state since 2001. So, if you have any sports betting winnings in Alaska, you will only need to worry about federal income taxes.

Learn more about betting in Alaska in our Alaska Sports Betting Guide.

Arizona Sports Betting Tax Rate

As with many other states, the Arizona betting tax rate depends on your annual earnings. The Arizona tax brackets are listed below.

- Income up to $26,500 is taxed at 2.59%.

- Income of $26,501 to $53,000 is taxed at 3.34%.

- Income of $53,001 to $159,000 is taxed at 4.15%.

- Income of over $159,000 is taxed at 4.50%.

As with all other states, a federal income tax of 24% is withheld whenever anyone wins a substantial amount.

Learn more about betting in Arizona in our Arizona Sports Betting Guide.

Arkansas Sports Betting Tax Rate

Arkansas recently underwent some changes to its tax system in 2019, so if you get any sports betting winnings, things have changed a bit over the last couple of years. As a state, Arkansas makes regular changes to the tax brackets, which account for inflation and cost of living.

Right now, there are currently three different brackets.

- Income of $0 is taxed at 2%

- Income of up to $4,300 is taxed at 4%

- Income of $8,500 or more is taxed at 5.50%

Learn more about betting in Arkansas in our Arkansas Sports Betting Guide.

California Sports Betting Tax Rate

California has undergone a few changes to the tax system over the last few years. The first change came in 2013, followed by another in 2018.

California has a robust tax bracket system, with 10 total brackets. So, depending on the number of winnings you receive, your tax rate can fluctuate mightily. The rates go between 1% and 13.3%.

- Income of $0 is taxed at 1%

- Income of up to $8,809 is taxed at 2%

- Income of up to $20,883 is taxed at 4%

- Income of up to $32,960 is taxed at 6%

- Income of up to $45,753 is taxed at 8%

- Income of up to $57,824 is taxed at 9.3%

- Income of up to $295,373 is taxed at 10.3%

- Income of up to $354,445 is taxed at 11.3%

- Income of up to $590,742 is taxed at 12.3%

- Income of $1,000,000 or more is taxed at 13.3%

Learn more about betting in California in our California Sports Betting Guide.

Colorado Sports Betting Tax Rate

If you manage to win money while betting in the Centennial State, you’ll be expected to pay state betting tax of 4.63%. The Colorado sports betting tax is a flat rate, so it remains the same for everyone lucky enough to win money. This flat tax rate replaced a tiered system, whereby higher earners paid higher tax on the money they’d won via gambling. Local income tax must also be paid by those living in Denver, Aurora, Sheridan, Glendale and Greenwood Village, although these are flat amounts payable by everyone. For example, everyone in Denver is required to pay $5.75 per month.

Learn more about betting in Colorado in our Colorado Sports Betting Guide.

Connecticut Sports Betting Tax Rate

While many other states have flat tax rates, those winning money in Connecticut will pay at different rates depending on their overall income for the year. There are seven brackets, which are detailed below.

- Income of $10,000 or less in a year is taxed at 3%.

- Income of $10,001 to $50,000 is taxed at 5%.

- Income of $50,001 to $100,000 is taxed at 5.5%.

- Income of $100,001 to $200,000 is taxed at 6%.

- Income of $200,001 to $250,000 is taxed at 6.5%.

- Income of $250,001 to $500,000 is taxed at 6.9%.

- Income of over $500,000 is taxed at 6.99%.

The maximum rate of tax will be withheld for those winning more than $5,000 and equal to or greater than 300x their bet. Those not residents in Connecticut will not be required to pay the Connecticut betting tax.

Learn more about betting in Connecticut in our Connecticut Sports Betting Guide.

Delaware Sports Betting Tax Rate

Delaware was one of the first states at the forefront of online poker play. Since 2009, the state has seen tax bracket changes, first in 2009 and then again in 2012.

Today, there are six total brackets, capped at 6.6%, and the final bracket starts with an income of $60,000.

- Income of up to $2,000 is taxed at 2.2%

- Income of up to $5,000 is taxed at 3.9%

- Income of up to $10,000 is taxed at 4.8%

- Income of up to $20,000 is taxed at 5.2%

- Income of up to $25,000 is taxed at 5.55%

- Income of $60,000 or more is taxed at 6.60%

Learn more about betting in Delaware in our Delaware Sports Betting Guide.

Florida Sports Betting Tax Rate

If you manage to win some money while betting on sport in Florida, there’s great news: you won’t be required to pay any betting tax to the state. This is because Florida is one of the states with no income tax. However, you will still have to pay income tax on money won to the federal government, as is the case in every state.

Learn more about betting in Florida in our Florida Sports Betting Guide.

Georgia Sports Betting Tax Rate

After changing the tax system in the state in 2009, Georgia recently updated its brackets and monetary amounts in 2018. Regardless of the bracket, the cap is set at 5.75%.

The final bracket, yearly earnings-wise, starts at $7,000. So, if you have a streak of good luck winning on sports betting, you could find yourself in the higher brackets.

- Income of $0 is taxed at 1%

- Income of up to $750 is taxed at 2%

- Income of up to $2,250 is taxed at 3%

- Income of up to $3,750 is taxed at 4%

- Income of up to $5,250 is taxed at 5%

- Income of $7,000 or more is taxed at 5.75%

Learn more about betting in Georgia in our Georgia Sports Betting Guide.

Hawaii Sports Betting Tax Rate

Although it’s not part of the Continental United States, Hawaii is still a spot where you can get sports betting winnings. The tax brackets were rearranged in 2016 and did not exceed 11%, with the lowest under 1.5%.

As you’ll see below, the tax rates are pretty manageable and do not surpass 6% until you reach nearly $10,000.

- Income of up to $2,400 is taxed at 1.4%

- Income of up to $4,800 is taxed at 3.2%

- Income of up to $9,600 is taxed at 5.5%

- Income of up to $14,400 is taxed at 6.4%

- Income of up to $19,200 is taxed at 6.8%

- Income of up to $24,000 is taxed at 7.2%

- Income of up to $36,000 is taxed at 7.6%

- Income of up to $48,000 is taxed at 7.9%

- Income of up to $150,000 is taxed at 8.25%

- Income of up to $175,000 is taxed at 9%

- Income of up to $200,000 is taxed at 10%

- Income of $200,000 and more is taxed at 11%

Learn more about betting in Hawaii in our Hawaii Sports Betting Guide.

Idaho Sports Betting Tax Rate

Each year, Idaho adjusts its tax brackets and associated tax rates. Like Arkansas, Idaho adjusts for inflation and cost of living. In prior years, the highest income threshold was over $11,000, but that has since changed. Additionally, the tax percentage rate cap has also dropped.

- Income of $1-$1,587 is taxed at 1%

- Income of $1,588-$4,762 is taxed at 3.1%

- Income of $4,763-$6,350 is taxed at 4.5%

- Income of $6,351-$7,938 is taxed at 5.5%

- Income of $7,937 or more is taxed at 6.5%

Learn more about betting in Idaho in our Idaho Sports Betting Guide.

Illinois Sports Betting Tax Rate

The Illinois sports betting tax rate is 4.95%. This is a flat rate, meaning that it applies to everyone winning money, regardless of how much money they win and how much their annual income is. Form IL-5754 must be filled out if you receive winnings worth over $1,000 and are a resident of Illinois. Those from out of the state need to fill in Form IL-1040 Schedule NR instead.

Learn more about betting in Illinois in our Illinois Sports Betting Guide.

Indiana Sports Betting Tax Rate

Now we move to Indiana, which has had legal offline and online sports betting since late 2019. The Indiana sports betting tax rate is 3.23%, which is pretty reasonable when compared to the betting tax charged by some other states. All counties in Indiana also levy a local income tax.

Learn more about betting in Indiana in our Indiana Sports Betting Guide.

Iowa Sports Betting Tax Rate

Those winning money in Iowa will need to pay tax, but the amount depends on the individual’s overall earnings for the year. There are nine different tiers, and we’ve outlined them below.

- Those earning up to $1,666 pay tax of 0.33% on all income.

- Those earning $1,667 to $3,332 pay tax of $5.50 plus 0.67% of everything earned over $1,666.

- Those earning $3,333 to $6,664 pay tax of $16.66 plus 2.25% of everything earned over $3,332.

- Those earning $6,665 to $14,994 pay tax of $91.63 plus 4.14% of everything earned over $6,664.

- Those earning $14,995 to $24,990 pay tax of $436.49 plus 5.63% of everything earned over $14,994.

- Those earning $24,991 to $33,320 pay tax of $999.26 plus 5.96% of everything earned over $24,990.

- Those earning $33,321 to $49,980 pay tax of $1,495.73 plus 6.25% of everything earned over $33,320.

- Those earning $49,981 to $74,970 pay tax of $2,536.98 plus 7.44% of everything earned over $49,980.

- Those earning over $74,971 pay tax of $4,396.24 plus 8.53% of everything earned over $74,970.

All substantial sports betting wins in Iowa are subject to a 5% withholding rate for state taxes, along with a 24% withholding rate for federal taxes.

Learn more about betting in Iowa in our Iowa Sports Betting Guide.

Kansas Sports Betting Tax Rate

Up to 2020, Kansas had a trend of changing its tax brackets and percentages every two years. One change came in 2016, followed by another in 2018. It’s unclear whether this will again change in 2022, but that is something to worry about next tax season.

Overall, the tax system is straightforward, with only three brackets and the percentages not exceeding 5.7%.

- Income of up to $15,000 is taxed at 3.1%

- Income of up to $30,000 is taxed at 5.25%

- Income of more than $30,000 is taxed at 5.7%

Learn more about betting in Kansas in our Kansas Sports Betting Guide.

Kentucky Sports Betting Tax Rate

Kentucky has a simplistic tax rate that is flat across the board. Regardless of income, you will have a flat state income tax rate of 5%. However, this is assuming you meet the threshold to need to file.

- A family of 1 must make more than $12,760

- A family of 2 must make more than $17,240

- A family of 3 must make more than $21,720

- A family of 4 must make more than $26,200

Learn more about betting in Kentucky in our Kentucky Sports Betting Guide.

Louisiana Sports Betting Tax Rate

Louisiana has had a very similar state income tax system for years now. The brackets were last changed in 2009, but the percentages have not updated since 2001.

With that said, there will be changes starting during the 2022 tax season. However, for now, the percentages range from 2%, 4%, and 6%.

- Income of up to $12,500 is taxed at 2%

- Income of up to $50,000 is taxed at 4%

- Income of $50,000 or more is taxed at 6%

Learn more about betting in Louisiana in our Louisiana Sports Betting Guide.

Maine Sports Betting Tax Rate

Starting in 2019, Maine began altering their overall state income tax to reflect the cost of living and inflation. Prior to that, the tax system had not changed since 2015.

Compared to 2020, the 2021 taxes are not that much different, but there is a slight difference in total income.

- Income of up to $22,450 is taxed at 5.8%

- Income of up to $53,150 is taxed at 6.75%

- Income of more than $53,150 is taxed at 7.15%

Learn more about betting in Maryland in our Maryland Sports Betting Guide.

Maryland Sports Betting Tax Rate

Maryland’s tax rate has not changed in more than a decade, last changing in 2010.

There are a total of eight brackets. The first three brackets see a whole percentage increase, followed by a 0.75% increase, while the latter four only rise by 0.25%. The overall income threshold shifts drastically from 4% to 4.75%, with an up to $97,000 difference.

The lowest rate is 2%, whereas the highest is just under 6% at 5.75%.

In Maryland, there is a gambling winnings tax rate of 8.75%. This does not explicitly state sports betting, but it does cover casino, pari-mutuel, and lottery winnings.

- Income of up to $1,000 is taxed at 2%

- Income of up to $2,000 is taxed at 3%

- Income of up to $3,000 is taxed at 4%

- Income of up to $100,000 is taxed at 4.75%.

- Income of up to $125,000 is taxed at 5%

- Income of up to $150,000 is taxed at 5.25%

- Income of up to $250,000 is taxed at 5.50%

- Income of more than $250,000 is taxed at 5.75%

Learn more about betting in Maine in our Maine Sports Betting Guide.

Massachusetts Sports Betting Tax Rate

The commonwealth of Massachusetts has not changed its tax brackets since 2001. To do this day, there is one bracket, with everyone paying the same rate. The rate right now is 5%, which is a change from 2019 with a rate of 5.05%. This rate changes in response to inflation and the cost of living.

However, if your gross income is less than $8,000, you will not need to file a state income tax return. Learn more about betting in Massachusetts in our Massachusetts Sports Betting Guide.

Michigan Sports Betting Tax Rate

Next up, we come to the Great Lake State. The Michigan sports betting tax currently stands at 4.25%, about the average for betting tax around the country. Various cities in Michigan also require a city tax to be paid, with the highest city income tax being the 2.4% tax found in Detroit. Other cities, including Grand Rapids, Highland Park, Saginaw, and Flint, also charge city income tax, which can be anything from 1% to 2%. Non-residents will also have to pay tax, at a rate of half that of residents.

Learn more about betting in Michigan in our Michigan Sports Betting Guide.

Minnesota Sports Betting Tax Rate

While there are only four tax brackets, the tax rate climbs fairly quickly in the state of Minnesota. Minnesota is another state that updates its state income tax brackets and rates yearly to reflect the cost of living and inflation.

From 2020 to 2021, there was a slight difference in overall income and how it determines the tax rate.

- Income of up to $27,230 is taxed at 5.35%

- Income of up to 89,440 is taxed at 6.80%

- Income of up to $166,040 is taxed at 7.85%

- Income of over $166,040 is taxed at 9.85%

Learn more about betting in Minnesota in our Minnesota Sports Betting Guide.

Mississippi Sports Betting Tax Rate

With three brackets, Mississippi tax rates climb by a single percentage, starting at 3% and going to 5%. The tax brackets have been the same since 2016; however, the rates haven’t changed since 2001.

In Mississippi, married couples file under the same tax brackets and rates. This is not like most other states, which have totally separate parameters in terms of brackets.

- Income of $1,000 and up to $5,000 is taxed at 3%

- Income of up to $10,000 is taxed at 4%

- Income of more than $10,000 is taxed at 5%

Learn more about betting in Mississippi in our Mississippi Sports Betting Guide.

Missouri Sports Betting Tax Rate

Missouri has nine state income tax brackets that increase by 0.5% other than the final bracket, which sees a rise of 0.4% compared to the previous. Married couples filing jointly have the same income tax brackets as well.

The following system has been in place since 2018.

- Income of $105 and up to $1,053 is taxed at 1.5%

- Income of up to $2,106 is taxed at 2%

- Income of up to $3,159 is taxed at 2.5%

- Income of up to $4,212 is taxed at 3%

- Income of up to $5,265 is taxed at 3.5%

- Income of up to $6,318 is taxed at 4%

- Income of up to $7,371 is taxed at 4.5%

- Income of up to $8,424 is taxed at 5%

- Income of more than $8,424 is taxed at 5.4%

Learn more about betting in Missouri in our Missouri Sports Betting Guide.

Montana Sports Betting Tax Rate

Montana betting tax is paid at the same rate as Montana income tax. The more you earn over a year, the more you will pay in taxes. The seven tax brackets are listed below.

- Income of up to $3,100 is taxed at 1%.

- Income of $3,101 to $5,400 is taxed at 2%.

- Income of $5,401 to $8,200 is taxed at 3%.

- Income of $8,201 to $11,100 is taxed at 4%.

- Income of $11,101 to $14,300 is taxed at 5%.

- Income of $14,301 to $18,400 is taxed at 6%.

- Income over $18,400 is taxed at 6.9%.

Payers in Montana should withhold 6.9% for state tax and 24% for federal tax when someone wins any prize worth over $5,000 and that prize is equal to or more than 300x the bet amount.

Learn more about betting in Montana in our Montana Sports Betting Guide.

Nebraska Sports Betting Tax Rate

With four state income tax brackets, the tax rates range from 2.46% to 6.84%. The tax rates have not changed since 2011, whereas the brackets change yearly to reflect the cost of living and inflation.

- Income of up to $3,340 is taxed at 2.46%

- Income of up to $19,990 is taxed at 3.51%

- Income of up to $32,210 is taxed at 5.01%

- Income of more than $32,210 is taxed at 6.84%

Learn more about betting in Nebraska in our Nebraska Sports Betting Guide.

Nevada Sports Betting Tax Rate

Nevada is known as one of the world’s gambling hubs, but it doesn’t have the best-developed online sports betting model. On the other hand, it has some of the best land-based sports betting found anywhere. Regardless of whether you win money online or offline, you’ll find that the Nevada sports betting tax rate is 0%, so you’ll only need to pay the federal tax.

Learn more about betting in Nevada in our Nevada Sports Betting Guide.

New Hampshire Sports Betting Tax Rate

If you gamble in New Hampshire and manage to win some money, we’ve got good news for you, as there is no New Hampshire sports betting tax. This means you only have to pay federal income tax on your winnings.

Learn more about betting in New Hampshire in our New Hampshire Sports Betting Guide.

New Jersey Sports Betting Tax Rate

New Jersey has become one of the centers of gambling in the US and currently has one of the most robust online sports betting markets in the country, but what is the tax on sports betting in the state? Well, the NJ sports betting tax rate differs depending on your income, and we’ve laid out the tax rates below.

- Income up to $20,000 are taxed at 1.4%.

- Income from $20,001 to $35,000 is taxed at 1.75%.

- Income from $35,001 to $40,000 is taxed at 3.5%.

- Income from $40,001 to $75,000 is taxed at 5.525%.

- Income from $75,001 to $500,000 is taxed at 6.37%.

- Income of over $500,000 is taxed at 8.97%.

When the payer is required to withhold money for federal tax, they are also required to withhold 3% state tax. The exact amount of tax you’ll need to pay depends on how much you’ve earned throughout the year – the withheld amount is just an estimate, so expect to pay more than this if you’re a high earner. Alternatively, those with lower earnings could get some of the withheld money back once their taxes have been filed.

Learn more about betting in New Jersey in our New Jersey Sports Betting Guide.

New Mexico Sports Betting Tax Rate

The four state income tax brackets in Mexico have remained the same since 2009. However, the tax rates have an even longer track record, staying the same 1.7% to 4.9% since 2007.

The percentages, especially on the lower end, are pretty reasonable compared to other states. The income brackets double when filing jointly as a married couple.

- Income of up to $5,500 is taxed at 1.7%

- Income of up to $11,000 is taxed at 3.2%

- Income of up to $16,000 is taxed at 4.7%

- Income of more than $16,000 is taxed at 4.9%

Learn more about betting in New Mexico in our New Mexico Sports Betting Guide.

New York Sports Betting Tax Rate

As with many of the other states we’ve profiled on this page, the amount of betting tax you’ll pay in New York depends on your overall earnings for the year. There are eight different New York income tax brackets, which we’ve listed below.

- Income up to $8,500 is taxed at 4%.

- Income of $8,501 to $11,700 is taxed at 4.5%.

- Income of $11,701 to $13,900 is taxed at 5.25%.

- Income of $13,901 to $21,400 is taxed at 5.9%.

- Income of $21,401 to $80,650 is taxed at 6.09%.

- Income of $80,651 to $215,400 is taxed at 6.41%.

- Income of $215,401 to $1,077,550 is taxed at 6.85%.

- Income of over $1,077,550 is taxed at 8.82%.

Those who win a substantial amount of money in New York will have 24% of their winnings withheld for federal tax, along with 8.82% for state tax.

Learn more about betting in New York in our New York Sports Betting Guide.

North Carolina Sports Betting Tax Rate

No matter your income, the North Carolina state income tax rate is 5.25%. This rate has been in place since 2018, and the sole bracket system has been this way since 2012.

Learn more about betting in North Carolina in our North Carolina Sports Betting Guide.

North Dakota Sports Betting Tax Rate

From 2020 to 2021, North Dakota saw a bit of a difference in income brackets; however, the tax rates have been the same since 2015. No matter your income, the percentage maxes out at 2.90%, with the lowest being just above 1% at 1.10%.

- Income of up to $40,125 is taxed at 1.10%

- Income of up to $97,150 is taxed at 2.04%

- Income of up to $202,650 is taxed at 2.27%

- Income of up to $440,600 is taxed at 2.64%

- Income of more than $440,600 is taxed at 2.90%

Learn more about betting in North Dakota in our North Dakota Sports Betting Guide.

Ohio Sports Betting Tax Rate

Compared to the 2020 bracket and tax rates, 2021 was much more favorable in both departments. Ohio adjusts its brackets and rates each year to reflect the cost of living and inflation.

There are five brackets, and the rate does not go beyond 3.99%.

- Income of $0 to $25,000 is taxed at 0%

- Income of $25,001 to $44,250 is taxed at 2.765%

- Income of $44,250 to $88,450 is taxed at 3.226%

- Income of $88,450 to $110,650 is taxed at 3.688%

- Income of more than $110,650 is taxed at 3.99%

Learn more about betting in Ohio in our Ohio Sports Betting Guide.

Oklahoma Sports Betting Tax Rate

Having not changed its brackets or rates since 2014, Oklahoma still has the same six brackets. The rates go from 0.5% to 5%, with the first two brackets having a 0.5% difference, followed by a single percentage change from brackets two through six.

The income threshold for the final bracket is just $7,200.

- Income of up to $1,000 is taxed at 0.5%

- Income of up to $2,500 is taxed at 1%

- Income of up to $3,750 is taxed at 2%

- Income of up to $4,900 is taxed at 3%

- Income of up to $7,200 is taxed at 4%

- Income of more than $7,200 is taxed at 5%

Learn more about betting in Oklahoma in our Oklahoma Sports Betting Guide.

Oregon Sports Betting Tax Rate

Oregon betting tax is determined by looking at how much you earn per year. There are four tax rates, which are described below.

- Income of up to $3,600 is taxed at 4.75%.

- Income of $3,600 to $9,050 is taxed at 6.75%.

- Income of $9,050 to $125,000 is taxed at 8.75%.

- Income of over $125,000 is taxed at 9.90%.

You will also find city income tax charged in some parts of Oregon. Anyone winning over $5,000 will have 8% withheld for state tax and 24% withheld for federal income tax.

Learn more about betting in Oregon in our Oregon Sports Betting Guide.

Pennsylvania Sports Betting Tax Rate

Pennsylvania is one of the more significant sports betting markets in the United States. The Pennsylvania sports betting tax rate is 3.07%. This is a flat rate, meaning that it is paid by everyone, regardless of how much they win and how much their annual income is. There are also state income taxes to pay in Pennsylvania, called Local Earned Income Tax. Philadelphia has the highest income tax, coming in at 3.8712%, while in Pittsburgh, the tax rate is a more reasonable 1.5%.

Learn more about betting in Pennsylvania in our Pennsylvania Sports Betting Guide.

Rhode Island Sports Betting Tax Rate

As with some other states, the Rhode Island betting tax rate varies depending on a person’s overall income over the year. The brackets are as follows.

- Income up to $65,250 is taxed at 3.75%.

- Income of $65,250 to $148,350 is taxed at 4.75%.

- Income of over $148,350 is taxed at 5.99%.

If the payer is required to withhold tax for federal purposes, it will also withhold state tax at a rate of 5.99%.

Learn more about betting in Rhode Island in our Rhode Island Sports Betting Guide.

South Carolina Sports Betting Tax Rate

While South Carolina updates their tax brackets each year to reflect inflation and the cost of living, there appears to be no change from 2020 to 2021. The tax rates, ranging from 0% to 7%, have been the same since 2007.

Overall, the rates have a 1% increase from the latter five tax brackets. However, we see a jump from 0% to 3% from the first to the second bracket.

- Income of up to $3,070 is taxed at 0%

- Income of up to $6,150 is taxed at 3%

- Income of up to $9,230 is taxed at 4%

- Income of up to $12,310 is taxed at 5%

- Income of up to $15,400 is taxed at 6%

- Income of more than $15,400 is taxed at 7%

Learn more about betting in South Carolina in our South Carolina Sports Betting Guide.

South Dakota Sports Betting Tax Rate

South Dakota is a state that has no state income tax whatsoever. This has been the case since around 2001, when it last changed. So, no matter what you make on sports betting, you will not be obligated to pay any state income taxes in South Dakota.

Learn more about betting in South Dakota in our South Dakota Sports Betting Guide.

Tennessee Sports Betting Tax Rate

Tennessee is one of the newer entrants into the sports betting market, and unusually, only online gambling is permitted in the Volunteer State. It’s a fantastic place to gamble, as the Tennessee sports betting tax rate is 0%, meaning those winning money in Tennessee will only be required to pay the standard federal tax.

Learn more about betting in Tennessee in our Tennessee Sports Betting Guide.

Texas Sports Betting Tax Rate

Texas is another state in which there is no state income tax. Like South Dakota, this has been the case since around 2001.

Learn more about betting in Texas in our Texas Sports Betting Guide.

Utah Sports Betting Tax Rate

No matter what your income is, Utah has a flat tax rate for all taxpayers. Right now, the rate is 4.95%, and it has been this way since 2018. Prior to this, the brackets changed in 2006.

The exact rate applies to married couples filing jointly too.

Learn more about betting in Utah in our Utah Sports Betting Guide.

Vermont Sports Betting Tax Rate

Like other states mentioned here, Vermont also changes its tax brackets yearly to reflect the cost of living in the state and inflation. However, the rates have remained the same since 2017, with a low of 3.35% and a high of 8.75% across four brackets.

- Income of up to $40,950 is taxed at 3.35%

- Income of up to $99,200 is taxed at 6.60%

- Income of up to $206,950 is taxed at 7.60%

- Income of more than $206,950 is taxed at 8.75%

Learn more about betting in Vermont in our Vermont Sports Betting Guide.

Virginia Sports Betting Tax Rate

The Virginia betting tax rate varies depending on how much someone earns in a year. These earnings include, among other things, money earned from an occupation and money earned via gambling. Here are the tax brackets for Virginia.

- Those earning $3,000 or less pay a tax of 2%.

- Those earning $3,001 to $5,000 pay tax of $60 plus 3% of anything over $3,000.

- Those earning $5,001 to $17,000 pay tax of $120 plus 5% of anything over $5,000.

- Those earning over $17,000 pay $720 plus 5.75% of anything over $17,000.

Virginia residents should report any winnings from gambling on Form 760. If you win money in any other state and had money withheld, use a Schedule OSC to claim the amount as a deduction against your tax liability in Virginia.

Learn more about betting in Virginia in our Virginia Sports Betting Guide.

Washington Sports Betting Tax Rate

Washington State does not have any state income taxes. It has been this way since around 2001.

Learn more about betting in Washington in our Washington Sports Betting Guide.

Washington D.C. Sports Betting Tax Rate

The District of Columbia has six tax brackets, and the rates have remained the same since 2014. The lowest rate is 4%, whereas the highest gets 8.95%.

The first three brackets are all $60,000 or less, but the last two are $350,000 and $1,000,000.

- Income of up to $10,000 is taxed at 4%

- Income of up to $40,000 is taxed at 6%

- Income of up to $60,000 is taxed at 6.5%

- Income of up to $350,000 is taxed at 8.5%

- Income of up to $1,000,000 is taxed at 8.75%

- Income of $1,000,000 or more is taxed at 8.95%

Learn more about betting in Washington D.C. in our Washington D.C. Sports Betting Guide.

West Virginia Sports Betting Tax Rate

West Virginia has different tax rates depending on the annual amount earned by an individual. We’ve summarized them below:

- Income up to $10,000 is taxed at 3%.

- Income of $10,000 to $25,000 is taxed at 4%.

- Income of $25,000 to $40,000 is taxed at 4.5%.

- Income of $40,000 to $60,000 is taxed at 6%.

- Income of over $60,000 is taxed at 6.5%.

State taxes are not usually withheld, but the state will withhold 6.5% when a winner does not provide identification.

Learn more about betting in West Virginia in our West Virginia Sports Betting Guide.

Wisconsin Sports Betting Tax Rate

Wisconsin tax brackets are indexed each year to account for inflation and the cost of living in the state. In comparison to 2020, 2021 has the same rates, but there are some differences in income.

While it is not significant, most brackets have a higher threshold, whereas the third of the four brackets have a lower requirement.

- Income of up to $12,120 is taxed at 3.54%

- Income of up to $24,250 is taxed at 4.65%

- Income of up to $266,930 is taxed at 5.3%

- Income of more than $266,930 is taxed at 7.65%

Learn more about betting in Wisconsin in our Wisconsin Sports Betting Guide.

Wyoming Sports Betting Tax Rate

While you’ll have to pay federal income tax on sports betting winnings earned in Wyoming, there is no requirement to pay any tax at all to the state, as Wyoming is one of the few states with no income tax.

Learn more about betting in Wyoming in our Wyoming Sports Betting Guide.

Discover Our Top Betting Guides

Offshore BettingOn the lookout for the best Offshore Betting Site? We have you covered, our guide compares the best gambling sites, providing top-tier bonus codes & more.Offshore BettingCash Out BettingJoin us as we look at the best Cash Out Betting Sites in the USA, providing useful tips, in-depth explanations and bonus codes.Cash Out BettingNew SportsbooksDon't miss out on the best New Sportsbooks in the USA 2023. Our guide covers everything you need to know, the latest features, bonus codes, & so much more.New SportsbooksHigh Limit BettingOur guide covers the best High Limit sportsbooks. Favoring those with the highest deposit limits, the largest welcome bonuses, and the best limits per wage.High Limit BettingSportsbooksDiscover more about the world of Sportsbook betting sites, reviewing the top 10 sites, where sports betting is legal, different types of bets, and much more.SportsbooksBetting AppsDo you prefer betting on your mobile? Explore betting on the go with our list of top-rated betting apps, featuring comparisons, top bonus codes, and more.Betting AppseSports BettingIn this guide, we cover everything you need to know about esports betting, from where it’s legal to what games are popular, to the top eSports betting sites.eSports BettingBest Sportsbooks on RedditThe Best Sportsbooks on Reddit - See which betting sites Reddit users rated as being the best. Join Today for $1,000 Bonuses and Free Bets!Sportsbooks on RedditPlay at the Top Online Sports Betting Sites

If you don’t want your tax to be automatically withheld, you should play at an offshore sports betting site. We specialize in reviewing the top offshore betting sites available to US gamblers, and we’ve listed the ten best below.

- BetOnline – The number one offshore sports betting site in the US

- MyBookie – Offers a generous selection of bonuses and promotions

- Everygame – Highly generous odds regularly on offer

- Xbet – A superb choice for anyone looking to bet on MLB

- Bovada – The sportsbook with the best overall selection of markets

- BetUS – The best sportsbook for betting on basketball

- BetNow – Great for those looking for fast withdrawals

- BUSR – The number one site for WNBA betting

- Jazzsports– The best place to go for horse racing betting

- Sportsbetting.ag – A top choice for fans of football betting

The Top Online Sports Betting Sites

Now that you’ve understood how tax works across various states, be sure to pick up an offshore sportsbook that you can trust. In order to help you there, we’ve done reviews on the top five.

1. BetOnline – The Number One Offshore Sports Betting Site in the US

If you’re looking to play at the best all-around offshore sportsbook in the US, you should head straight over to BetOnline. They offer everything a fan of sports betting could want, including a fantastic array of different markets, on sports including basketball, football, and horse racing.

What’s more, these markets usually have decent odds, so you can be sure you’re going to get nice returns on any successful bets you place. However, we still recommend that everyone checks the odds at various websites before placing a bet.

You’ll also find that BetOnline is a great place to visit if you’re looking for decent bonuses and promotions. The welcome BetOnline promo code alone can add up to $1,000 to your account balance, plus you’ll also find that there are bonuses designed especially for those depositing using cryptocurrency

The BetOnline mobile website is also a fantastic one, which works perfectly with smartphones and tablets of all shapes and sizes. There’s also a mobile app to download, but this is only available to those with an Android device.

What we like:

- Deposit using many cryptocurrencies

- Great selection of bonuses, including a $1,000 welcome bonus

- Simple to bet using the mobile website and Android app

- Massive variety of betting markets

- A trustworthy site founded back in 2004

What we don’t:

- No iOS app available

2. Bovada – The Sportsbook with the Best Overall Selection of Markets

Next on our list of the best offshore sportsbooks available to US gamblers is Bovada. This is an exceptionally well-known site, having had some issues in the past, but we can assure you that these have been resolved, and Bovada is now a superb place to play.

This is the case for both desktop and mobile players, the latter of whom can enjoy betting using either their mobile browser or the fantastic Bovada mobile app, available for both iOS and Android.

The number one reason to visit Bovada is the superb selection of sports betting markets on show. They’ve got pretty much everything covered, from popular competitions, such as the NBA and NFL, to more niche competitions from various countries.

There’s an entire section of the site dedicated to horse racing, plus the live betting platform is one of the best around, offering loads of betting options, decent odds, and an intuitive interface.

Bovada also has some fantastic promotions, including a Bitcoin sports betting welcome bonus worth up to $750. You’ll also find that it has a nice loyalty scheme to reward regular players. Enjoy playing poker and casino games too? If so, you’ll also find some great bonuses in these sections of the Bovada website.

What we like:

- Superb selection of betting options

- Fantastic mobile app for iOS and Android users

- Great live betting platform

- $750 welcome bonus for Bitcoin users

- Poker and casino games also available

What we don’t:

- Somewhat shady past, but reputable now

- High fees attached to credit card deposits

3. MyBookie – Offers a Generous Selection of Bonuses and Promotions

Next up, we come to MyBookie, which is the place to go for anyone looking for fantastic bonuses and promotions. Not only can you earn upto a a free $1,000 on your first deposi by using a MyBookie promo code, but you can also claim a reload bonus worth up to $500, as well as an 8% rebate on horse racing losses.

There is also a massive 250% referral bonus, plus those who also enjoy playing casino games will find daily promotions waiting to be claimed. There are also some terrific contests, which have some superb prizes.

You’ll also find an incredible array of different betting options, with the live betting platform really standing out from the crowd. It looks great, plus it’s straightforward to use, allowing you to make live bets quickly before the opportunity passes. You’ll be able to bet live on basketball, football, motorsports, and much more, plus you’ll nearly always find great odds available.

As with many of our top offshore sportsbooks, you’ll find that cryptocurrencies can be used to deposit and withdraw at MyBookie. The cryptocurrencies available are Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Ripple.

What we like:

- Superb selection of bonuses and promotions

- Get an 8% rebate on all horse racing betting losses

- Deposit using a range of cryptocurrencies

- Fantastic live betting platform for desktop and mobile users

- Great selection of horse racing markets

What we don’t:

- Fees for bank wire and e-check withdrawals

- No loyalty scheme available

4. Everygame – Highly Generous Odds Regularly on Offer

Everygame is a long-standing and renowned online bookmaker. The sportsbook has successfully catered to bettors’ needs of varying skill levels thanks to its extensive and regularly updated sports betting variety.

A one-stop shop for a wide variety of gambling options, including sports betting and casino games, Everygame players benefit from a single login for a fully-featured sportsbook, a poker room, a live dealer, and two casinos, making it a very convenient option no matter what your gambling preference is.

While there is a wide selection of promotions, Everygame promo codes, and a hefty welcome bonus available at all times, the wagering requirements on this offer could be a little lower.

As it stands, Everygame delivers a reasonably satisfying experience to bettors, and the sportsbook’s trustworthy reputation does a great deal to instill confidence in its users.

What we like:

- Solid promotion offers

- Mobile-friendly

- Wide variety of payment options

- Accepts US players

- 24/7 customer support

What we don’t:

- Limited video poker and table games

- Slow payouts for bank wires and checks

5. Xbet – A Superb Choice for Anyone Looking to Bet on MLB

In first place is Xbet, a site that offers various betting options, but is particularly noticeable for its array of MLB markets. You’ll be able to bet on a wide variety of markets on every game, plus there are many futures available.

Live betting on MLB is also a very strong aspect of this site. However, don’t worry if you also enjoy betting on other sports, as you’ll find top coverage of basketball, football, and more at Xbet.

But why else should you consider betting at Xbet? Well, the bonuses are particularly impressive, with new players given a sign-up bonus worth up to $500 just by using one of the many Xbet promo codes. Plus, horse racing betting fans getting a 7% rebate on their losses.

Xbet is also a great place to play if you enjoy casino games, as it has a fantastic selection of online slots, as well as table games and live dealer games.

You’ll be able to deposit at Xbet using a range of cryptocurrencies, but there aren’t many other depositing options. What’s more, those depositing using anything else other than cryptocurrency will find that the minimum deposit is high.

What we like:

- Superb place to bet on MLB

- Plenty of bonuses, including a $500 sign-up bonus

- Deposit using several cryptocurrencies

- 7% rebate on horse racing betting losses

- Great live betting platform

What we don’t:

- Lack of non-cryptocurrency banking options

- No loyalty scheme offered

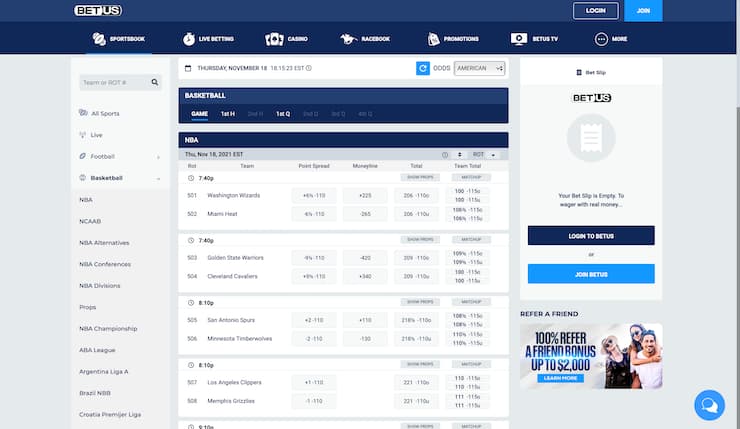

6. BetUS – The Best Sportsbook for Betting on Basketball

Another fantastic choice for those looking for a top offshore sportsbook is BetUS. Its most significant attribute is the superb selection of basketball markets on offer – something that should be of interest to many readers of this site!

You will, of course, be able to bet on all NBA encounters, but it’s the chance to bet on other leagues, such as those from Argentina, England, and Sweden, that really makes this site stand out from the others.

You’ll also find that BetUS is fantastic for those also looking to play casino games, as well as bet on sports. You’ll find that this site offers a giant range of exciting online slots, as well as some great table games. You’ll also find a superb live casino, which contains games run by a dealer beamed live to your screen using a webcam.

Looking for some superb bonuses? This is another area in which BetUS excels, especially if you prefer to deposit using cryptocurrency. There’s a 200% cryptocurrency bonus for new players, which can be worth up to $2,500, plus there are also huge reload bonuses explicitly aimed at those depositing using cryptocurrency. Four cryptocurrencies can be used to deposit, namely Bitcoin, Litecoin, Bitcoin Cash, and Ethereum.

What we like:

- 200% cryptocurrency bonus for new players

- Superb online casino also available

- Fantastic selection of basketball betting options

- Huge reload bonuses on offer

- Deposit using four different cryptocurrencies

What we don’t:

- Non-cryptocurrency withdrawals have high minimum

7. BetNow – Great for Those Looking for Fast Withdrawals

BetNow was launched in 2015 and immediately seized a sizable share of the market by offering competitive bonuses, quick payouts, and lucrative odds. The online sportsbook has significantly grown in popularity over the past two years. While US and Canadian bettors are the main target market, BetNow accepts customers from the rest of the world.

BetNow is based in Curacao and has a license from the Curacao Gaming Board, so players don’t have to worry about legitimacy issues. SSL encryption software is available to ensure your credentials are kept under wraps. BetNow has also maintained a good reputation for delivering timeous payments, so you’re pretty much guaranteed to receive your winnings.

In addition to the BetNow welcome promo code, players receive a lifetime reload promo determined by how much you initially deposit. You won’t find such a cool feature at most competing online bookies. For example, a $500 initial deposit will grant you a 10% lifetime re-up bonus in the VIP program.

What we like:

- Competitive betting lines on major US sports

- Generous deposit bonus

- Flexible deposit limits

- Lifetime re-up promo

What we don’t:

- Relatively high rollover requirements

8. BUSR – A List Betting Site for Sport, Casino, and Horse Racing

BUSR gives you some of the best odds on US sports games, and the integrated live betting feature makes it even more satisfying to use this bookie if you love backing your team while the game is in play.

There are many markets that you can bet on at BUSR, including MLB, NBA, NHL, NFL, NCAA Football, NCAA Basketball, horse racing, CFL, MMA, esports, cycling, cricket, international hockey, table tennis, and more. The best part is that you can find odds comparison tables for all of these sports. This way you know which site is the best to place your bets on.

Besides the market depth, BUSR is an all-in-one betting site with casino, racebook, and sportsbook features. So whether you like table games like blackjack, roulette, baccarat, video poker, or Texas Hold’em, BUSR has you covered.

This bookie offers great bonuses to crypto users when depositing with crypto, and also a 150% bonus of up to $2,500 for new users depositing with regular fiat currencies.

What we like:

- All-in-one sports betting, casino, poker, and esports site

- Welcome bonuses, reload bonuses, free bets, and contests.

- Cryptocurrencies and multiple banking options are available

- High deposit/withdrawal limits

- Fast payout time

What we don’t:

- Most payouts have varying fees.

9. Jazzsports– Top Quality Racebook and Sportsbook

Founded in the mid-nineties Jazz Sports has a wealth of experience and puts it to good use. Boasting a sportsbook that offers competitive odds on a variety of sports, a top-quality casino, and one of the best racebooks available online makes it a worthy choice for any bettor.

All the most popular US sports such as football, basketball, baseball, hockey, tennis, and soccer are all covered in depth on this site. For football and basketball, in particular, the NFL and NBA have a huge amount of prop bets and futures on offer as well as superb odds on the moneyline and spreads.

On top of its excellent sports betting options, Jazz Sports has a phenomenal racebook. It covers all the big races around the world including the Kentucky Derby, the Breeders Cup, and the Dubai World Cup to name just a few. There is racing available 365 days a year and with a 10% horse rebate on offer, it is the ideal place for horse racing.

In addition to the excellent horse rebate promotion, there is also a great Jazz Sports bonus code for new customers, which is a matched deposit worth up to $1,000. You will also find other regular promotions and bonuses on offer once you are signed up.

What we like:

- All-in-one sports betting, casino, poker, and esports site

- Large welcome bonus.

- Great racebook with a large rebate

- Regular promotions

- Competitive odds on US sports

What we don’t:

- Not the largest selection of sports

10. Sportsbetting.ag – A Top Choice for Fans of Football Betting

SportsBetting.ag is your “go-to” site for the most exciting sports betting action. You can find a vast selection of sports and betting options on the board, plus poker and other casino betting options.

Football (NFL), basketball (NBA), baseball (MLB), golf (PGA), tennis, boxing, and mixed martial arts (MMA) are just some of the many popular North American sports offered by SportsBetting.ag. Bets can also be placed on a variety of international sports, such as Australian rules football, darts, soccer, cricket, snooker, handball, and rugby.

Other forms of gambling include esports, casino games, poker, and horse racing. Simply said, SportsBetting.ag has more betting possibilities across more sports than anywhere else on the globe! New players can take advantage of a 50% welcome bonus up to $1,000 by entering the SportsBetting.ag promo code. .

Better yet, Sportbetting.ag offers a wide variety of payment options including fiat and cryptos, with fast payouts. Also, the casino’s website is simple and very user-friendly, making it easy for players to navigate.

What we like:

- All-in-one sports betting, casino, poker, and esports site

- Play SportsBetting poker on your mobile browser or app.

- Welcome bonuses, reload bonuses, free bets, and contests.

- 12 cryptocurrencies, multiple banking options

- High deposit/withdrawal limits

What we don’t:

- No eWallets

- Most payouts have varying fees.

Explore Our Expert-Written Sports Betting Guides

NBAA comprehensive guide to betting on the NBA at the best betting sites in the US, featuring detailed reviews of the sportsbooks, lines, and odds.NBA BettingUFCEverything you need to know about betting on the world's most popular MMA organization, the UFC. Discover the best UFC sportsbooks and learn about the markets.UFC BettingMLBWhether it's the run line or parlay betting on the World Series, our MLB betting guide details everything you need to know about baseball betting in the US.MLB BettingNHLSkate over to the top hockey sportsbooks and claim huge bonuses when you register. Read up on puck line betting and other popular NHL betting markets.NHL BettingHorse RacingUnsure how to wager a trifecta at Preakness Stakes, or a quinella at Belmont? Our detailed horse racing betting guides will reveal all.Horse Racing BettingNFLA complete guide to betting on America's Game. Learn how NFL odds and markets work, read our reviews of the top NFL sportsbooks and prepare to beat the spread.NFL BettingNCAABFrom the NBA Draft to March Madness and everything in between, our NCAAB betting guide sets out the key components to betting on college basketball.NCAAB BettingEsportsDiscover the best esports betting sites for the world's most popular games: CS:GO, FIFA, CoD, WoW, and more. Use promo codes to claim rewards when you sign up.Esports BettingTennisOur team of betting experts presents a comprehensive overview of tennis betting markets, odds, key dates, and the best tennis sportsbooks in the USA.Tennis BettingGolfHoping to bet on The Masters, Ryder Cup, or US Open this year? Read our comprehensive golf betting guides first to increase your chances of success.Golf BettingPoliticsPlenty of sportsbooks now offer politics betting markets. Learn how to profit during the elections and claim lucrative sign-up bonuses when you register.Politics BettingBoxingLearn how to profit from the sweet science by reading our detailed boxing betting guide. Swing the odds back in your favor with reload bonuses and free bets.Boxing BettingConclusion: Paying Tax on Sports Betting

If you’ve read this entire page, the question of “do you pay tax on sports betting” should be one you can answer. However, here’s a little recap: if you’re in the US and you win any amount of money from sports betting, you are expected to pay tax, on a federal level and also often on a state level. Earn enough, and the payer could even take away 24% of your winnings and send them straight to the IRS, along with state tax as well, to make sure your taxes are at least partly paid.

If you would rather not risk your winnings being withheld, you should play at an offshore sportsbook. You’ll find that we’ve listed the best offshore sportsbooks on this page, with our number one offshore sportsbook being Xbet. Why not make your way over to Xbet today and see if it’s the perfect sportsbook for you?

50% Welcome Deposit Bonus Up To $500 + $10 Casino Chip

Get Offer FAQs

Are there taxes on sports betting?

Yes, there are. These are in line with federal income tax, meaning that they range from 10% to 37% of income. Some states also charge income tax, plus there are some cities in the United States that also charge income tax too.

Is betting tax free in USA?

No, you will be expected to pay tax on all winnings. Whether you choose to report these winnings is entirely down to you, although substantial wins – those of $600 or more, as well as equal to or greater than 300x your bet – are reported to the IRS by the payer. However, offshore sportsbooks do not report any earnings to the IRS.

How do I avoid taxes on gambling winnings?

The best way to avoid paying tax on gambling winnings is to play at an offshore site, as they don’t report any winnings to the IRS. If you choose not to pay tax on gambling winnings, you risk prosecution should the IRS find out.

What percentage is sports betting taxed at?

Sports betting winnings are taxed at the same rate as most other income, such as income from your job. This is the case at both state and federal levels.

Is sports betting reported to IRS?

No, only wins that require Form W-2G to be issued are reported to the IRS. This form is issued whenever someone wins at least $600 and the prize is 300x the value of the wager or more. Offshore sports betting sites, such as those recommended on this page, do not report any sports betting winnings to the IRS, regardless of their size.

James is a professional copywriter with over 10 years of experience, specializing in online gambling, including sports betting and casino. He's also a huge sports fan, happy watching anything from March Madness to obscure lower league English soccer. Other interests include movies, food, and travel.

- Former Lakers center Kwame Brown calls LeBron James a ‘stat sheet junkie’

- ESPN’s Mike Greenberg thinks ‘The Celtics should win every single game’ after being down 3-0 to Miami

- Dallas’ Kyrie Irving could have a shoe deal signed with Adidas in the near future

- Sixth Man of the Year Malcolm Brogdon has been playing through a torn tendon in his shooting hand

- Heat guard Gabe Vincent (left ankle sprain) downgraded to questionable for Game 5 vs. Celtics

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/betonline-3.jpg)

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/bovada-sport-1.jpg)

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/mybookie-sport-1.jpg)

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/xbet-nba.jpg)

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/busr-1.jpg)

![Sports Betting Tax in [cur_year] - Can You Be Taxed on Sports Betting Winnings?](jpg/image-2022-11-01t105229.150.jpg)